Author: Frank, PANews

The stablecoin market is very busy. According to incomplete statistics from PANews, 30 stablecoin projects have officially announced financing since the second half of this year. Usual, a decentralized stablecoin project backed by U.S. Treasury bonds, also announced its Series A financing on December 23, led by two major exchanges, Binance Labs and Kraken Ventures. With the market already dominated by established giants such as DAI and USDe, do stablecoin newcomers still have room to survive? Does the rising TVL indicate that it will become another popular stablecoin? In this article, PANews will explore the core potential and risks of Usual from the perspectives of its underlying operating logic and revenue distribution design.

From the operational logic, Usual is no longer operated by a centralized organization, but is governed by the community on the chain. In addition, in terms of revenue distribution, Usual will remit 100% of the revenue generated into the protocol treasury to give back to the community, and in terms of token distribution, 90% of the tokens will be allocated to the community, and 10% of the tokens will be allocated to the team and investors.

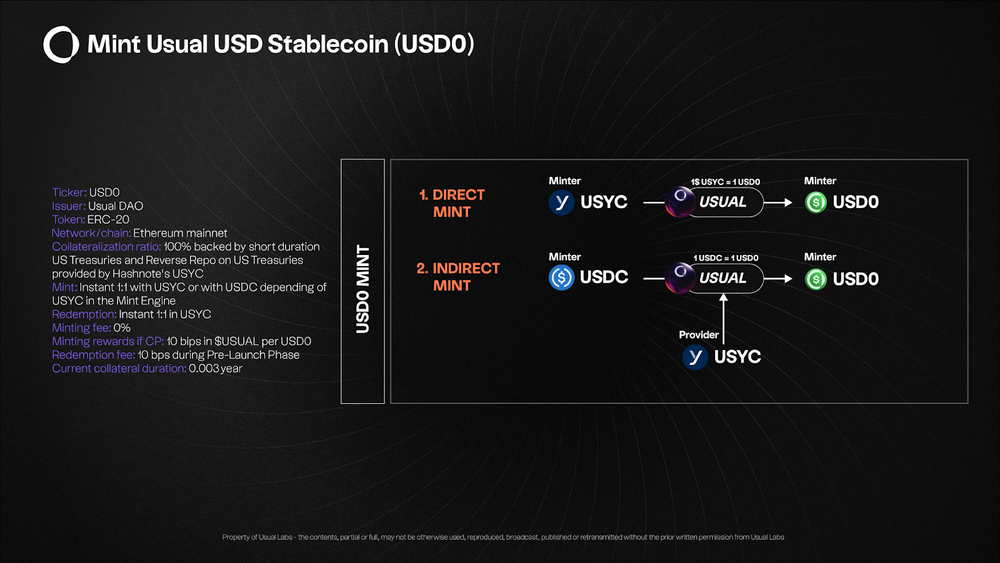

The core issuance mechanism of stablecoins is the collateral mechanism. Especially for fiat stablecoins, collateral assets are the most critical factor in ensuring asset security and stablecoin stability. The stablecoin product currently issued by Usual is USD0. The special thing about this stablecoin is that it does not use traditional collateral such as cash and gold. Instead, it chooses U.S. ultra-short-term Treasury bonds (T-Bills) with a term of only a few weeks to a few months and extremely high liquidity and stability as collateral assets, because it is backed by national credit and is regarded as a "risk-free return" category, thereby reducing dependence on commercial banks. Ultra-short-term Treasury bonds have more advantages in credit and liquidity, which is why Usual calls itself the RWA stablecoin issuer.

However, there is a key point here. If you directly purchase low-risk products such as ultra-short-term treasury bonds, you can indeed achieve lower risks. But PANews learned from Usual's official documents that Usual itself does not directly purchase U.S. treasury bonds, but through cooperation with Hashnote, it invests the mortgage funds in a "packaged" treasury bond/reverse repurchase product (USYC).

In other words, Usual does not personally buy government bonds or operate reverse repurchases, but instead entrusts the collateral assets to Hashnote, a partner that has undergone due diligence, for management. Although Hashnote is also a regulated partner, it has registered entities in the Cayman Islands and the United States, and the asset types of the cooperation between the two parties are ultra-short-term government bonds that are almost risk-free. However, under this model, cooperation with commercial banks such as Tether may not be absolutely lower risk. However, Usual’s goal is to allow the community to vote together to decide on the future provider of collateral assets, and it is not necessarily always Hashnote. Recently, Usual announced a partnership with Ethena and BlackRock’s tokenization platform Securitize to use BUIDL and USDtb as collateral. From then on, USD0’s collateral assets will no longer be limited to USYC.

In order to encourage users to mint and use USD0, Usual launched USD0++ for incentives and designed a game mechanism. USD0++ is a staking version of USD0. Users can earn income by staking USD0 and the official governance token USUAL. As of December 25, the annualized yield of USD0++ exceeded 64%, and it once exceeded 80%. This high yield also attracted a lot of funds to participate in the minting of USD0.

However, the design of USD0++ is different from other LSTs. The unified expiration date of USD0++ is June 30, 2028, a four-year lock-up period. During this period, users can continue to receive USUAL token rewards, but this does not mean that users must deposit funds regularly for four years. USD0++ itself is a transferable token that can be bought and sold in the secondary market, which allows holders to "cash out" or transfer through transactions even before maturity.

In addition, Usual has designed three exit mechanisms, namely USUAL Burning Redemption, Price Floor Redemption, and Parity Arbitrage Right.

Among them, the more special one is USUAL Burning Redemption. When the user wants to burn and redeem, he needs to return part of the USUAL reward before redeeming it (the refund amount is adjusted dynamically).

In addition, the Usual white paper also mentioned that the USD0++ model can be replicated to other assets (such as ETH0++, dUSD0++, etc.), which means that this unique LST mechanism is not only limited to fiat stablecoins, but can also be extended to other collateral or cross-chain ecosystems.

In general, USD0++ is designed to encourage users to hold for the long term, accumulate USUAL tokens during the lock-up period, share growth dividends with the protocol, and unify the expiration date to reduce users' tendency to speculate in the short term. At the same time, USD0++ is a tradable "note" and retains a certain degree of liquidity. Finally, an exit game is adopted. If you exit early, you need to burn USUAL or repurchase through an arbitration mechanism. An "exit cost" is set to protect the protocol from the impact of a run and protect the rights and interests of those who stay.

In addition to adopting decentralized operations and introducing RWA assets as collateral, the token economic model of Usual's governance token USUAL is also quite unique. Unlike other fixed issuance or one-time issuance methods, USUAL adopts a dynamic casting model for token issuance.

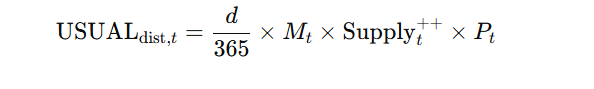

USUAL tokens are not minted all at once, but are dynamically minted every day based on a series of formulas and parameters and distributed to different "deposit and loan, liquidity, and reward" pools.

This dynamic formula is composed of multiple factors, namely: d: Global distribution rate (0.25), which is equivalent to the inverse of the 4-year target issuance cycle. Supplyt++: The total supply of USD0++ at present (locked scale). Pt: The main market price of USD0++ (taken as 1 when anchored at 1 USD). Mt: Dynamic casting rate, which is determined by several factors (supply, interest rate, growth, etc.).

Each of these factors is calculated according to several other formulas, and the specific calculation process will not be explained in detail here. In general, the characteristics of this issuance mechanism are as follows: 1. Gradually "reduced production" as the scale of USD0++ increases. 2. Adjusted with changes in market interest rates. When the FED or market interest rates rise and the actual benefits that the project can obtain are higher, the system will moderately increase the issuance of tokens to allow participants to get more USUAL rewards; otherwise, production will be reduced. 3. DAO can be manually intervened, and "manual corrections" can be made for extreme market conditions or inflationary pressures to ensure the long-term stability of the protocol. 4. Early incentives and later scarcity. In the startup phase, the supply of USD0++ is relatively low. At the same time, if the market interest rate or reward mechanism is set high, there will be a phenomenon of "early casting rate" being high, attracting pioneers to participate. Over time, TVL and interest rates change dynamically, and the casting rate will gradually stabilize or decrease, forming a process similar to "halving" or "production reduction".

In short, USUAL's issuance mechanism attempts to find a self-adjustable balance between "stablecoin scale expansion, real income improvement" and "value-added for token holders", so as to incentivize early users and ensure scarcity and fairness in the later stage. This issuance model is similar to Terra's previous model, except that Usual only applies this design to governance tokens, and does not adopt this model for the issuance of stablecoins.

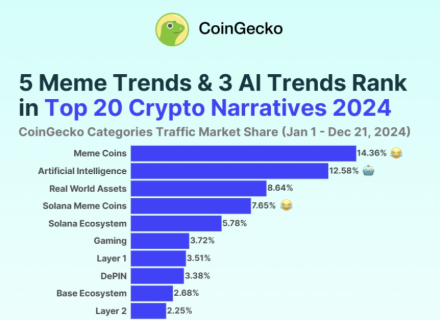

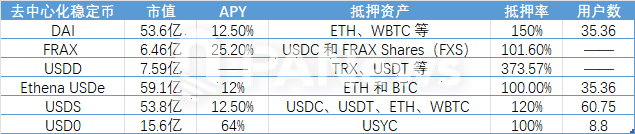

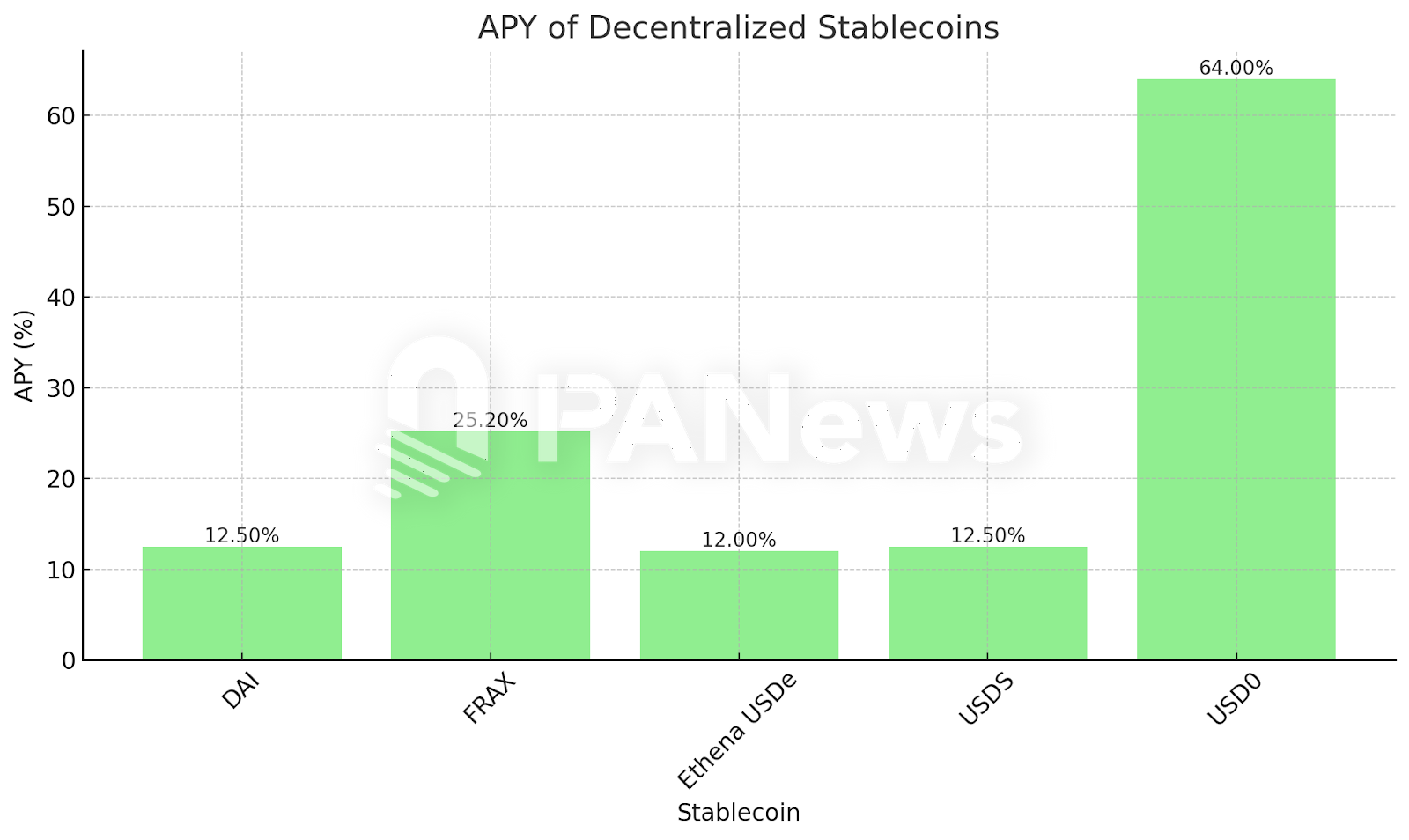

Currently, there are already many projects in the decentralized stablecoin market. What opportunities does Usual have in this market? PANews conducted a data comparison of the current mainstream decentralized stablecoins.

In terms of circulation, the decentralized stablecoin with the largest circulation is Ethena USDe at $5.91 billion, followed by USDS and DAI. However, these projects have been running for a long time. In terms of development speed, USD0's current TVL has reached $1.56 billion (data on December 25). On December 1, Usual's TVL was only $490 million, which has increased three times in less than a month. Currently, USD0's market value ranks among the top five centralized stablecoins.

This rapid growth may be due to the high-yield flywheel model. Usual's annualized rate of return is 64%, the highest among several stablecoin yield comparisons. If this rate of return can continue, it will likely grow into the next decentralized stablecoin giant.

In addition, Usual’s biggest advantage may also come from the fact that the risk of collateral assets is minimal. The collateral assets of other decentralized stablecoins generally use fiat stablecoins and mainstream crypto assets. The risk factor of the ultra-short-term U.S. Treasury bonds used by Usual is significantly lower.

On Usual's homepage, "Becoming Bigger Than BlackRock" is displayed at the top as a vision, which also shows Usual's ambition. Compared with the industry leader Tether, Usual and other decentralized stablecoins still have a long way to go. The circulation of USUAL tokens is 473 million, with a market value of approximately US$676 million. Based on the current income level, the average distributed profit per token is approximately US$0.125. From the design of the token economic model, this is similar to the recently popular Hyperliquid. The common point between the two is that they have a certain profitability, and at the beginning of the design, they claimed that most of the income would be fed back to the community in the form of tokens.

Recently, Usual and Binance have been working together frequently, including listing, airdrops, and on December 23, Binance Labs announced that it led Usual's $10 million Series A financing. This excitement reminds people of Binance Labs' early investment and support for Terraform Labs, although that investment was ultimately doomed to fail. Can today's Usual become another rising star that Binance Labs has bet on in stablecoins?